Australian Taxation Office Debt Collection Trends and Policies in 2024.

Share

The Australian Taxation Office (ATO) plays a crucial role in revenue collection and ensuring compliance with tax laws. As we step into 2024, the ATO faces significant challenges in managing debt owed by individuals and businesses. Let’s explore the debt collection trends and policies shaping the ATO’s approach.

The Growing Debt Burden

At the end of January 2024, the ATO reported that collectible debts had surpassed $50 billion. Small businesses account for almost two-thirds of this debt1. The key components of this debt include:

- Unpaid GST: Small businesses have collected billions of dollars in Goods and Services Tax (GST) from their customers but failed to remit it to the ATO.

- Pay As You Go Withholding (PAYGW): Employers withhold income tax from employees’ wages but sometimes withhold payment to tax authorities.

- Pay As You Go Instalments (PAYGI): Businesses have deferred payments, affecting their overall tax obligations.

- Superannuation Guarantee: Employers owe billions in unpaid superannuation contributions1.

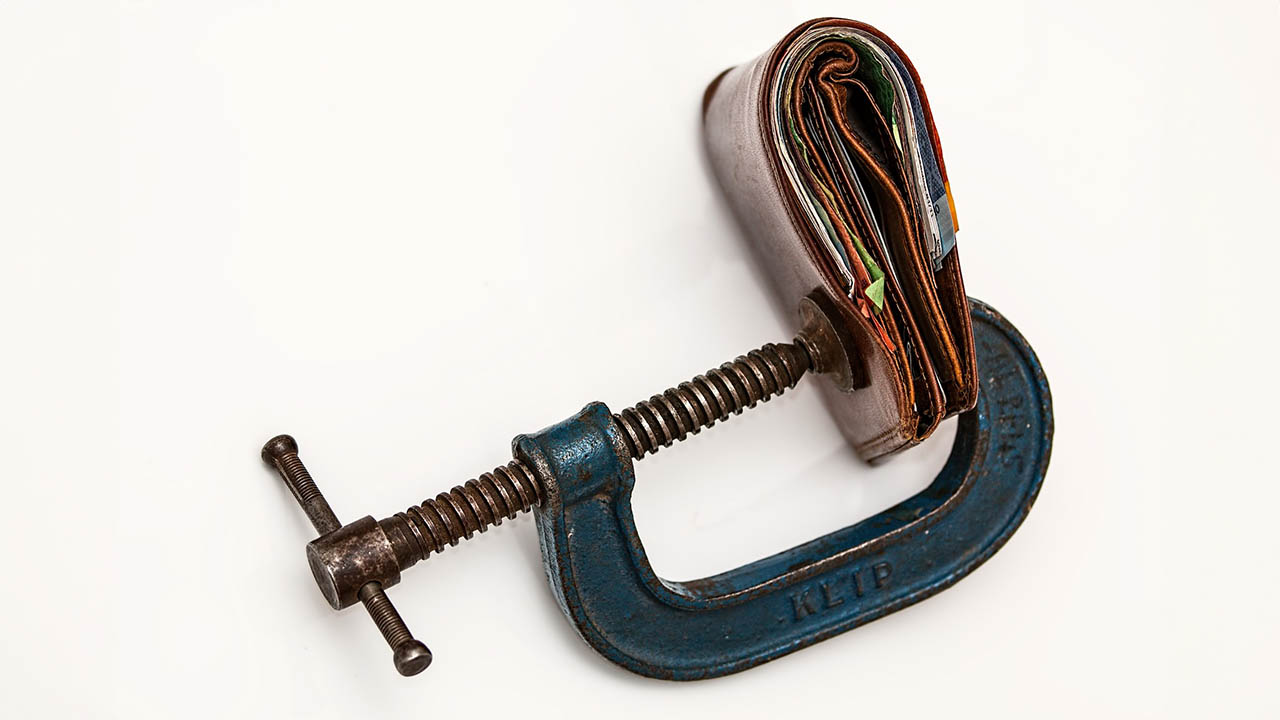

Aggressive Debt Collection Strategies

The ATO has shifted toward firmer debt collection actions. Here are some notable trends:

- External Debt Collection Agencies: From January 29, 2024, debt cases may be actioned by an external agency called “recoveriescorp” to recover outstanding amounts2.

- Disclosure to Credit Reporting Bureaus: The ATO may disclose debt information to credit reporting agencies, impacting credit scores.

- Director Penalty Notices (DPN): The ATO may issue a DPN which imposes personal liability on the directors for certain tax debts owed by a company.

- Court-Imposed Liquidation: Persistent non-payment could lead to court-imposed liquidation, potentially pushing businesses into bankruptcy1.

Impact on Small Businesses

Experts warn that aggressive debt collection could have severe consequences for small businesses. Thousands of businesses may be hit with winding up application notices if they cannot meet their obligations. The ATO acknowledges the challenge and emphasizes the importance of timely tax and superannuation payments1.

Balancing Enforcement with Sensitivity

While debt recovery is essential for revenue collection, the ATO must strike a balance. It must consider the financial health of businesses, especially during economic recovery from the pandemic. Sensitivity to individual circumstances is crucial to avoid unintended consequences.

Conclusion

As the ATO continues its debt collection efforts, businesses and individuals must prioritise timely payments. Staying informed about tax obligations, seeking professional advice, and managing cash flow are critical. The ATO’s policies will shape the financial landscape in 2024, impacting both taxpayers and the broader economy.

Remember, compliance today ensures financial stability tomorrow.

Small Business Restructuring

The Small Business Restructuring (SBR) provides a lifeline for financially distressed companies, allowing them to restructure debt while retaining control.

For any distressed small business with an otherwise viable business model, an SBR should be the restructuring tool of choice to relieve historical debt problems. SBR can save your small business at least cost and interruption. Feel free to contact your local Rodgers Reidy office to discuss whether this option is right for your clients.

Note: This article provides an overview of the ATO’s debt collection trends and policies in 2024.

References:

- ATO chasing small business GST and income tax debts worth billions

- Doing Business in Australia: Insolvency Snapshot for 2024

- ATO chases small businesses for $34b in debt, insolvencies tipped to hit GFC levels

- Australian Taxation Office (ATO) shifting to firmer debt collection activity